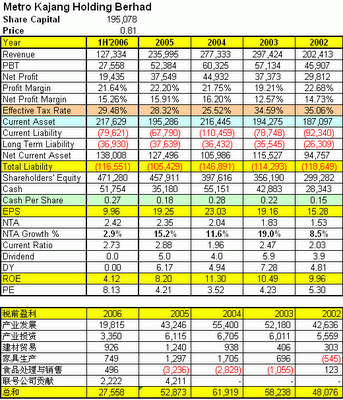

每股盈利 = 4.33分 VS 前期3.4分,上半年为9.96分VS 前期6.31分。

Metrok 第2季度的成绩单比我预期来得差些,尤其是它的产业发展显然已开始随着产业低迷走下坡。虽然季报指出它“locked-in unbilled sales value”约RM160.38 million,这些unbilled sales也许还能够为它的产业发展业务维持好几个季度的荣景;但若metrok未能够及时推出大型的产业发展计划取代PD2贡献的话, 那metrok2008年的成绩单可就不怎么可观了。

食品处理与销售部终于在这次的季报开始转亏为盈,赚取约0.6mil的税前盈余。 假设它的食 品处理能够在每季度都获得0.5mil的盈利,那全年化的盈利贡献 =〉 2mil。食品处理的总资产为32.1mil, 那ROA就是约6.2%,投资两年后就能够为集团带来盈利并有约6.2%的毛回酬率总算还过得去(上半年的折旧为0.6mil)。 Metrok最近宣布80%子公司以约1千万零吉的代价收购Yang Farming Sdn Bhd以扩展它的食品处理部,Metrok文告中所提供的资料并不多,只是交待了资产价值但却完全不提CYFSB过去的业务表现(依我看来,Yang Farming Sdn Bhd过去几年的业绩应该是不怎么标青了。)

注:写于6月3日

CYFSB was incorporated in Malaysia on 8 September 1976 as a private limited company and is involved in livestock farming and oil palm cultivation. CYFSB owns approximately 224.26 acres (nett area) of freehold agriculture lands and a piece of leasehold agriculture land (lease expired) of 3.85 acres, all in Daerah Kinta, Perak. The market value of the lands including farm buildings was RM8.5 million valued by Rahim & Co Chartered Surveyors Sdn Bhd on 28 April 2006. The net book value of the land and buildings as per the audited accounts of CYFSB as at 31 December 2005 was RM646,058-00. The adjusted fair value of CYFSB is approximately RM10,800,000-00. As at the date of announcement, CYFSB has an authorised and paid-up capital of RM800,000-00 and RM800,000-00 respectively.

成绩单

没有评论:

发表评论